Newsletter

Email sales@hsbrisbaneproperty.com.au to receive the latest newsletter.

Banks survive – Property alive

National economic outlook has a prominent influence on the property market – directly and indirectly ... and banks play a pivotal role in this economic landscape.

The majority of property buyers take out a loan, as an investor or as a home owner, from banks or other lending institutions. In fact over 90% of home loans are funded by the banking sector, and over 80% of all mortgages are through the 'big four' bank groups, ANZ, Commonwealth, Westpac and NAB.

When the banks are sound then property lending is also sound.

Recent comments by the Assistant Governor of the Reserve Banks of Australia (RBA), Malcolm Edey, were not widely publicised but provided an interesting insight into the Australian banking landscape and why we faired better in the GFC than other countries.

Why did our banks survive the GFC while others floundered?

The key to the answer lies in the limited expansion of Australian banks compared to other countries, which then protects them from further possible corrections, according to Malcolm Edey.

There were "certain elements of bubble-like behaviour in the few years leading up to the GFC" in some countries where the financial sector became too large compared to the size of the country's economy.

Why didn't this happen in Australia?

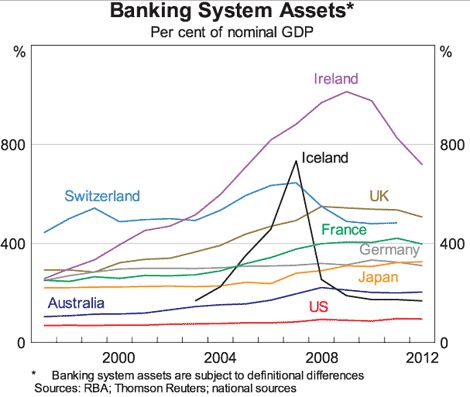

Let's look at some of the countries that didn't fair well in and after the GFC. The total assets of the Irish banking system peaked in 2009 at a ratio of nine times its annual GDP as well as Iceland, where the ratio peaked at seven times its GDP and to a lesser extent, but still above historical norms, the UK, where the peak was around a ratio of five to one, and even European 'powerhouse' Germany peaked just under the four to one ratio.

The following chart shows Australia's banking sector compared to other countries.

"In Australia the banking sector did expand relative to the economy, but it remains significantly smaller than many others. On the rough metric of banking assets to GDP, Australia's ratio is about two, which is well within the international range and well below those in the euro area, the UK and Japan," explained Edey.

"So to the extent that any generalised financial overhang exists, it is less likely to be a problem here than elsewhere. That said, attitudes to risk and debt accumulation in the Australian household sector have clearly changed. Saving rates are up, the appetite for new debt is down, and attitudes to both the level and composition of household saving have become more conservative."