Why a property depreciation schedule is a must for any astute investor

Preparing a tax return for the Australian Taxation Office (ATO) can prove a rather hectic exercise for anyone, let alone an investor. However, it is one that can prove very rewarding if done correctly. From our perspective, the key to getting the most out of your assets is to ensure no stone is left unturned! This means claiming all possible entitlements… starting with making the most of property tax depreciation.

Whilst June 30 has been and gone it certainly does not mean tax time is over. The lodgement period for 2014/2015 tax returns runs from July 1 until October 31. So while advertisers may have stopped singing to the tune of happy EOFY for another year, the time to lodge tax returns is still well and truly among us - at least for another month anyway.

As we know, when purchasing a property, the contents start to depreciate in value - much like a car. Thankfully the ATO enables investors to potentially claim this depreciation on certain items (like fixtures and fittings) at the end of every financial year. In this case October 31.

Such depreciating assets can certainly add up over the years. For that reason alone, it is really important not to overlook them.

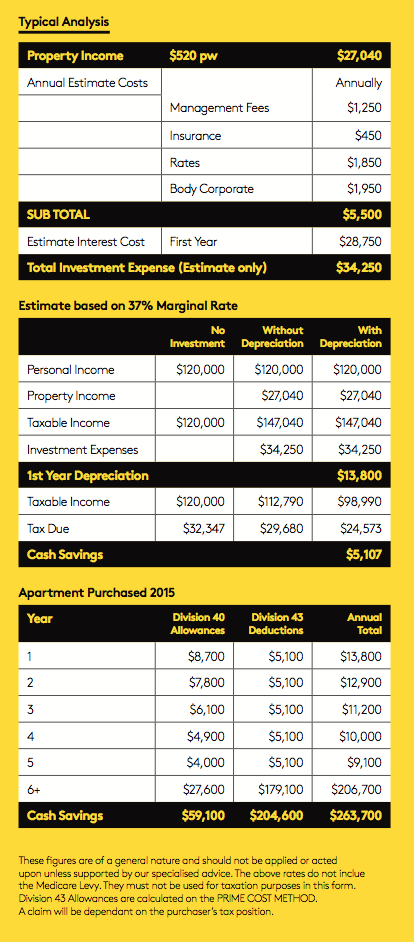

For instance, let us take a look at an example by consultants,NBtax by Napier & Blakeley of a typical analysis:

This example perfectly highlights why it is imperative for investors to devote much-needed time and resources into a quality depreciation schedule. Clearly the results of a professional schedule are extremely beneficial and, if done right, have the power to increase the figures of an investor’s bank balance come tax time.

Before starting the first thing to do is find an expert property depreciation specialist; someone who will conduct a thorough onsite review of the property – this includes measuring, photographing and recording all eligible depreciable assets. Following the inspection they will also prepare a detailed tax depreciation schedule showing how much value each item will lose (depreciate) every year, up to 40 years.

Hannah Schuhmann, Principal of HS Brisbane Property, says there are numerous benefits to having a tax depreciation specialist, such as a quantity surveyor, come out and visit the property.

“Having a quantity surveyor inspect your property and compile a report is so easy and can take away a lot of stress from an investor. Best of all, it can make the world of difference come tax time”, says Hannah.

Hannah believes another major advantage of commissioning a specialist to help calculate depreciation is that it provides a transparent overview of what can, and cannot, be claimed. Thus, allowing the investor to have more control of their assets – not their accountant.

Chris Page from NBtax by Napier & Blakeley, could not agree more.

“Most accountants recognise that using a quantity surveyor saves you time and money and puts you in the driving seat when it comes to good asset management; ask yours how they are making the most of the opportunities available to you”, said Mr Page.

So the question remains… how to find the right quantity surveyor to prepare that special report? Hannah recommends finding someone who is a member of the professional industry body, Australian Institute of Quantity Surveyors (AISQ), and is a registered Tax Practitioner.

So, whether you need a new report or would like to have someone look over your existing schedule, finding a depreciation specialist is a great start towards making a big difference to that next tax return.

For more information on this and other profitable investment tips, speak to us at HSBP on 0419 782 133.