Federal Budget 2014

Over the past few weeks there has been one topic that has been the darling of the media, the 2014 Federal Budget. In the weeks leading up to the announcement it was all about pondering the potential gloom and doom it could mean for the average Australian citizen, and where we were most likely to see cuts as the Abbott government delivered their first Federal Budget.

Post May 13, we have seen every media portal put forward their analysis on the new budget and where it did, and did not live up to the drab expectations they had so fiercely put upon it. From health cuts to newly formed taxes it certainly has stirred up some controversy and emotion from all corners of the country. What we are really interested in, is how the newly released budget is going to affect the residents of Brisbane and in turn, what influence this may have on the inner city property market going forward.

To do this we will take a quick look at a few key demographics and what changes the 2014 Federal Budget will mean for them:

First Home Buyers

First home buyers took a particularly bad hit with the budget with the axing of the First Home Saver Accounts Scheme (FHSAS). The FHSAS was initially established by the Rudd government in 2008 as a way to further entice new buyers into the market. The scheme offered those saving for a deposit for their first home incentivising tax breaks as well as monetary contributions from the government. At the end of 2013 there were over 46,000 accounts containing in excess of $521 million dollars.

The announcement of the termination of this scheme will see the government contributions end on the 1st of July this year and the tax and social security concessions withdrawn from July 2015. This may see a decrease in the number of new home buyers entering the market long-term however presents a wonderful opportunity over the next 12 months (before the scheme disappears in July next year) for those 46,000 account holders to make the most of their share of the $521m currently saved and purchase their first home or unit.

As the deadline of July 2015 draws nearer we are more likely to see an influx of new entrants into the property market, with inner city units/townhouses likely to be a crowd favourite.

Those nearing retirement

The proposed rise to the pension age / superannuation preservation age, will see retirement delayed for many older Australians. While superannuation will still be a essential means of preparing for retirement we are likely to see an increase in the number of Australian’s diversifying their investments and savings. This is where we could see some further action in the real estate market as more investors look to property to expand their portfolio.

Properties in the inner CBD of the major capital cities such as Brisbane present an attractive option to these such investors looking to spend under $500k but still achieve good returns and long-term growth.

Families – changes to taxes & benefits

The rules governing Family Tax Benefits have been drastically tightened with the income threshold dropping from $150k to $100k, and it will mean around 570,000 families around Australia losing their entitlement to the Family Tax Benefit Part B.

Wealthy Australian’s earning more than $180k a year will also be hit with an additional 2 per cent income tax to pay off the nations’ debt.

While these changes are not going to be welcomed by many and initially may hit the hip pockets of many Australian families quite hard, there have also been some positives to come out of the budget.

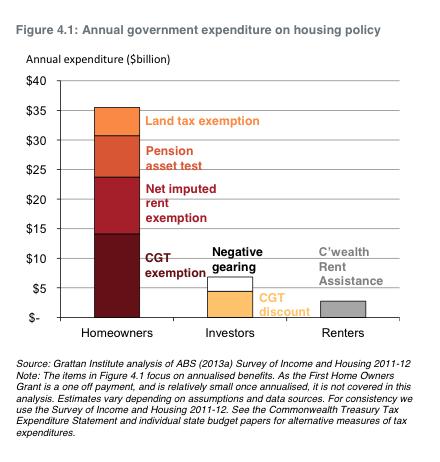

One of the big wins was confirmation that negative gearing tax breaks will remain intact for the next 12 months, allowing investors to breathe a sigh of relief. Another announcement welcomed by the real estate industry in particular was verification that the Capital Gains Tax (CGT) free status will remain untouched for owner occupiers. Changes to CGT in the other direction could have had a negative impact on the affordability of properties for many families so this is definitely good news for those looking to buy or sell in the coming year.

Data from the Grattan Institute suggests that 90 per cent of private housing subsidies generally go to property owners over private renters (see graphic below). This includes around $30 billion CGT benefits for owner occupiers and $7 billion negative gearing for landlords per annum.

If you, like many, after reading pages of budget analysis from all over the web are having trouble ascertaining exactly how the budget is going to affect your particular circumstance - we suggest you view the interactive ‘Budget Calculator’ the Courier Mail has put together. Simply visit http://www.couriermail.com.au/business/federal-budget-2014-calculate-exactly-what-it-means-for-you/story-fnihpj8r-1226916514203#, scroll down to the end of the page, answer a few questions about your circumstances and it will give you a rundown of which changes will directly affect you this year.

(Source: 'Industry Experts on Australia's 2014 Federal Budget', Property Observer - May 12, 2014; See more at: http://www.propertyobserver.com.au/forward-planning/investment-strategy/politics-and-policy/31155-property-observer-exclusive-industry-experts-on-australia-s-2014-federal-budget.html)