The Great Aussie Debate: Interest rates

It's a fascination for every economist, property analyst and property buyer/seller ... the change-reaction effect of interest rates on the economy as a whole and property prices. Too high? Too low? Going up? Down? Sideways?

But it's way more than an 'Aussie issue' - it affects every country and it's often interesting to look at what the global monetary organisation, the International Monetary Fund, is saying. This, coupled with comment from our own Reserve Bank head, Glenn Stevens, makes for very interesting reading.

Following is a good article*, from the current Eureka Report published by well-known economist, Alan Kohler, covering many currently discussed issues in Australia and placing them in relation to the 'big picture'. Take a few minutes to read, and perhaps find some new insights into what I'm calling Australia's 'great rates debate' ...

"The property debate is heating up in Australia. Not surprisingly much of it is negative, reflecting a combination of three factors. A very aggressive public relations effort to talk the market down; a view that property values are rich – above any reasonable fundamental assessment; and the belief that households are heavily indebted.

I've mentioned before why this analysis is incomplete. As a brief reminder, although total debt is important sure, the ability to service that debt is what matters the most. With interest rates at generational lows and debt servicing at about a decade low, households can afford to take on a lot more debt from current levels. At this point, noting that household debt is at a record to incomes isn't as relevant as taking note of where the debt servicing ratios are.

The scare campaign is overdone

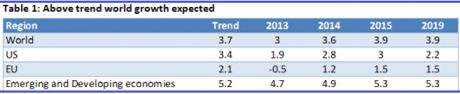

Now, it is true to say that rates will eventually rise and with them debt servicing ratios. Indeed, any sensible person would take a look at the global and domestic economic backdrop and rightly think that the tightening cycle could start soon. Domestically, jobs have surged in 2014 – and far from rising, the unemployment rate dropped to 5.8%. Looking abroad, activity is picking up as well. Certainly the International Monetary Fund's more optimistic tone this week would lend itself to that idea. I mean, the fact is they are expecting robust growth. Take a look at table 1 below from the IMF.

Global growth is expected to rise considerably in 2014, to 3.6% from 3% last year. That's around trend. In the ensuing years, global growth is expected to be above trend. Not so shabby. Perhaps, more importantly, the IMF has effectively cut the risk of another global recession to zero and it noted that "downside risks have diminished overall".

This is an upbeat statement, not what we are used to from the IMF. Taken against the domestic property discussion, there are certainly grounds for 'buyers to beware'. As the RBA governor Glenn Stevens (and others) like to point out, property prices fall – especially when interest rates tend to rise.

Don't panic!

Yet, if you are concerned about rate rises and what they might mean for your investments, the simple message from global policymakers is – you needn't be. This is the most notable aspect of the IMF's report, the key takeaway, especially as it comes alongside an expected upswing in global growth. The way I see it, the key contribution of the IMF's report this week, its primary purpose, was to help lay the theoretical foundations for ultra-low rates for a long time to come yet. This builds upon Larry Summers' (professor at Harvard University and policy heavyweight) work last year in resurrecting the idea of secular stagnation – the idea that growth will remain very weak for many years to come.

The IMF does note that, over the medium term, monetary policy would be expected to be neutral. That is, not stimulating the economy any further. However, it goes on to state that this should only occur once the output gap is closed (the difference between what growth could be if it was firing properly, and what it actually is). Here's the thing, though. Output gaps aren't expected to be closed anytime soon, certainly not over the next five years. So while the IMF reckons that global growth will be above trend over the next five years – growth in Europe and the US will be below what it considers to be trend (you can see that in table 1). It is up front about it, actually noting: "Policymakers in advanced economies need to avoid a premature withdrawal of monetary accommodation."

Effectively, the IMF is buying into the idea of secular stagnation. I dealt with the idea of secular stagnation last year. It's a theory from the 1930s that has been debunked already. That being the case, I certainly don't see it having any merit now. In my view there hasn't really been any change in global growth dynamics – I'm just not seeing that in the data. The only thing to change is how that growth is being characterised. So, for instance, in the US above trend growth, which is what we've got now, is described as 'disappointing' and 'below potential', notwithstanding the fact that growth now is stronger than the average recorded during the pre-GFC boom. Were people talking about secular stagnation prior to the GFC? No, of course not, it was a boom! It is my view that this is all by policy design. Governments are heavily indebted, and the western financial system simply can't really afford a normalisation in interest rates. So it's not going to happen.

Why does any of this matter?

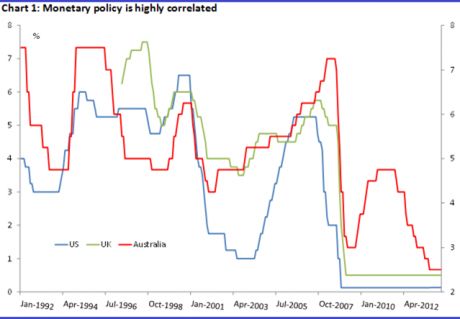

It matters a lot, because the fact is, in a global world, monetary policy is coordinated. Maybe not directly – I'm not suggesting the Fed phone up the RBA and tell them to cut rates. However, as chart 1 below shows, the correlation between monetary policy in the advanced economies (US, UK and Australia shown below) is a close one over time.

As the chart shows, there are variations: sometime rates go up or down independently of the other central banks – for instance, the RBA's hikes through 2009-10. But they are never by much and never for long. In the Australian context, rates soon came tumbling down. It's the same through modern economic history – in the main and over time, rates across the central banks tend to move together.

With that in mind, it is highly improbable in my view, that if the Europeans are on the verge of printing money, soon to conduct their own version of quantitative easing, and that if Japan shows no sign of ending its QE program (having had one for the last 14 years), that the US Federal Reserve is going to embark on an aggressive rate tightening cycle.

At the very least the US dollar would surge higher, as would Treasury yields – and that isn't something the US wants. Bringing it back home then, if central banks in Europe, Japan and America are going to keep rates ultra-low or an ultra-long time (and they are), then there is very little chance the RBA will tighten aggressively.

Walking the rates line

That's not to say that rates won't lift here before they do in the US or Europe. I suspect they will, and indeed the RBNZ has already led the way with a 25 basis point rate hike last month. Moreover, if the property market doesn't slow a bit, that the RBA will deliver a rate hike – 25bp here or there – as a warning shot, as it were, across the bow. Having said that, it is not in a position to conduct an aggressive tightening cycle on its own. Not unless it wants to see the $A at around the $US1.20 mark, and that isn't going to happen. We saw in 2011 the power of the dollar lobby – the RBA slashed rates while the economy was expanding to its strongest growth rate in five years. Economic data was effectively ignored through the easing cycle as the RBA changed its focus to the currency. While the $A may attract less policy attention at this point, I don't think the currency would have to move too much higher for the exchange rate target to come back into prominence.

Two other things to consider:

- Without a surge in commodity prices, global inflation is going to remain low. Commodity prices in turn aren't going to surge higher, or are unlikely to, given the significant degree of regulatory pressure in this space. This is most directly on the price of crude.

- Secondly, Glenn Stevens himself suggested rates would be lower going forward than in previous cycles.

The bottom line is that global policymakers are doing everything in their power to ensure that rates remain low for as long as possible.

That's why the emergency measures put in place to fight a depression after the GFC are still in place, despite the IMF placing a near zero probability on a renewed global recession. QE continues. This has impacted, and will continue to impact, domestic policy settings and ensure that debt servicing remains low and easily manageable for some time yet.

Don't be alarmed then by charts stating that debt to GDP is X%, or at a new record, or whatever. The fact is, and this was a key message from the IMF this week, that central banks will act to ensure that debt servicing remains very affordable."

* 'Rate debate: No need to Panic', Adam Carr - Eureka Report, 11.04.2014

(Source:, Eureka Report, Louise Moeller - HS Brisbane Property marketing consultant)